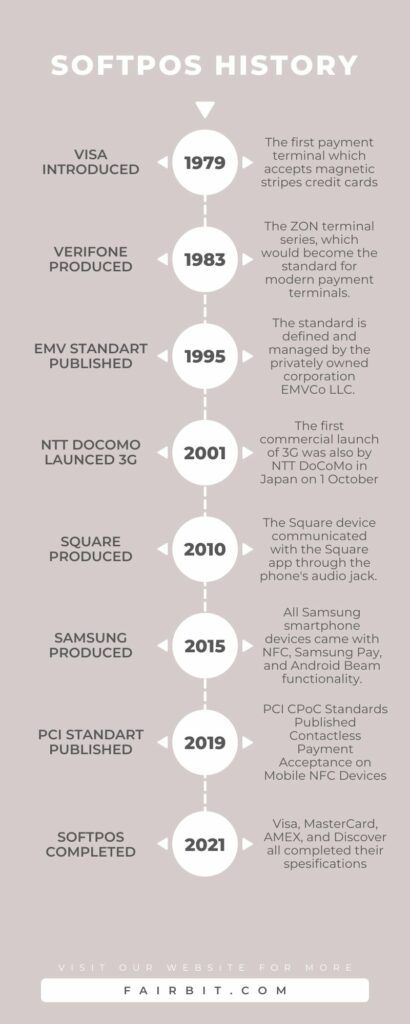

Traditionally POS devices have always been hardware-centric. If you go 20-30 years back, you can remember the large size and heavy POS hardware devices in merchant locations with dial-up modems, lengthy power cables, and large printers.

By the time, POS companies began to investigate smaller size devices with better internet connectivity (ethernet, 3G, 4G) and better processing capacity. However, the problem was still there: expensive hardware, difficult to carry (for the on-the-go type of transactions), challenging to maintain, many hardware issues, and so forth.

When Square announced the first time Square Reader in 2010, an MSR reader accepting credit card payments by using a mobile device’s audio jack, most people didn’t take it seriously. Other POS vendors claimed that it was insecure and vulnerable. However, this was a need in the market. Merchants loved this small device even though it was not secure enough. The device was tiny and simple. It was easy to carry, easy to maintain, and cost-effective. However, there was still a big problem there: With the October 15 EMV liability shift in the U.S, this small reader should have been converted to an EMV chip device, meaning to maintain a complex EMV logic on the hardware and EMV certification requirements, which ended up with the increase in the cost and size.

From 2015, another evolutionary thing happened in the market: Android phones have started to come with an NFC interface. This was cool. Any phone with an NFC interface would be able to read EMV contactless cards. However, we still had blockers for the SoftPOS technology: Very few NFC-enabled Android phones, very few contactless cards, and a lack of regulations by PCI and EMV.

2019-2020 years marked a significant milestone to open the way for SoftPOS technology. PCI announced CPOC standards to capture and process the account data securely on the software platforms. Visa, MasterCard, and all other brands defined new EMV standards for SoftPOS. And in 2020, due to COVID, there has been a tremendous increase in the number of contactless cards. And finally, almost all Android phones in the market had the NFC interface.

When 2021 has arrived, the market is finally completely ready for SoftPOS technology. And Fairbit announced a solution to meet all requirements of ISOs, ISVs, Payfacs, and acquirers to offer the SoftPOS solution to their merchants. SoftPOS solution is very well-thought, well-designed, cloud-based, EMV certified, secure, easy to integrate, easy to deploy, and easy to maintain. With the EMV-Kernel-on-the-Cloud technology, the solution eliminates the burdens of hardware-based solutions. This gives an excellent opportunity to players in the market to offer this cool technology to their customers.

With the Fairbit SoftPOS solution, there is no need to have the hardware to take payments. Any Android phone can accept card-present payments securely. The solution has a great market fit for small merchants. Merchants don’t need to buy, set up, and maintain POS hardwares. They don’t need to deal with hardware issues. They can download the POS application from the App Store and start using it immediately. There is no hardware cost. Merchants can take payments anywhere in the store or on-the-go. This is a cool solution, especially for small merchants like door-sellers, barbers, coffee shops, and many others. 2010 has marked a new era with mPOS technology. 2020 years will mark another new era with SoftPOS technology. We are ready to go. Let’s go.